The probate process in Delaware is a complex and lengthy one that can be difficult to understand. It is important to familiarize yourself with the laws and regulations as it pertains to settling an estate after a house sale in order to ensure that everything proceeds smoothly.

Generally, the time it takes for an estate to settle depends on many factors such as the size of the estate, whether or not there are creditors involved, and the number of beneficiaries. In most cases, the executor or administrator of the estate is responsible for collecting all of the debts owed by the deceased before any distributions can be made.

This includes filing all necessary tax returns, resolving any outstanding debts or court matters, and ensuring that all assets are properly distributed among heirs and beneficiaries. The process may take anywhere from six months to several years depending on how quickly these tasks can be completed.

Additionally, it is important to note that if there are any disputes between heirs or creditors, this can delay the completion of probate significantly. Understanding this process thoroughly beforehand will help ensure that your Delaware estate is settled efficiently and without complications.

When it comes to estates in Delaware, it's important to understand the tax obligations associated with a home sale. Estimating estate taxes and other taxes is essential for settling an estate after a house sale. Delaware has a realty transfer tax of 3% of the total purchase price, which is split between the buyer and seller. Estate taxes are also applicable, with a rate of

8% up to 1 million dollars and increasing based on value; however, there are exemptions available for family transfers or transfers involving charities or government entities. Additionally, depending on the county in which the property is located, there may be additional transfer taxes that will need to be paid before settlement can take place. It's also important to remember that all personal income taxes must be settled before closing on an estate sale in Delaware. Understanding these tax obligations prior to a house sale will help ensure that an estate can be settled quickly and efficiently, without any delays due to unpaid taxes.

In Delaware, determining who is entitled to inherit after a house sale requires an understanding of the estate's settlement process. The time it takes to settle an estate after a house sale in Delaware is usually determined by the complexity of the estate and the number of assets involved.

Most estates require 6-12 months for completion but may take longer depending on how much paperwork needs to be filed and how many heirs are involved. In Delaware, each heir must be identified, located, and notified of their inheritance rights.

Furthermore, all debts must be paid before any assets can be distributed to heirs. Once all debts are settled and divided among the beneficiaries, whatever remains is then distributed accordingly.

It is important to note that property cannot be transferred until all creditors have been paid in full and the probate court has approved the final distribution of assets.

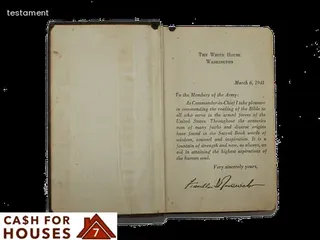

When it comes to the process of settling an estate after a house sale in Delaware, one of the major distinguishing factors is whether or not there is a will. If the deceased person left behind a valid will, this is known as a testate situation.

In this case, the executor named in the document has the responsibility for administering and settling the estate according to its terms. On the other hand, if there is no will then it is known as an intestate situation.

In that case, Delaware law provides for how assets are to be distributed among heirs. Furthermore, if there are minor children involved, Delaware law also provides for how their interests can be protected.

In both situations, there are certain documents and procedures which must be followed in order for an estate to be settled properly and efficiently. This includes filing all necessary paperwork with the probate court and ensuring that any debts or taxes due by the deceased have been paid before distributing assets among beneficiaries.

The length of time it takes to settle an estate varies depending on its complexity but typically ranges from six months to two years.

When a house is sold in Delaware, it is important to understand the rules and regulations concerning inheritance tax liability. In Delaware, inheritance taxes are imposed on the transfer of assets from one individual to another, either through a will or through intestacy laws.

The amount of inheritance tax due is determined by several factors including the relationship between the deceased and the beneficiary, the value of the estate, and any applicable deductions. Calculating these factors accurately is essential for ensuring that inheritance taxes are paid in full.

Additionally, understanding how long it takes to settle an estate after a house sale in Delaware can help provide peace of mind to those involved in the process. It usually takes approximately three months for an estate to be settled and all taxes paid after a house sale in Delaware; however, some factors such as disputes between beneficiaries or business interests may extend this timeline significantly.

The process of settling an estate in Delaware after a house sale can be complex and time-consuming. It is important to ensure that all necessary paperwork is correctly filed with the state of Delaware.

This includes forms related to inheritance tax, estate tax, probate documents, and other court filings. Depending on the complexity of the estate, it can take several weeks or even months for all necessary forms to be processed by the state.

In addition to filing forms with the state, individuals may also need to file any applicable federal taxes or documents. To ensure that all paperwork is filled out correctly and submitted in a timely manner, it is best to work with experienced legal professionals who are familiar with local laws and regulations.

Navigating through the estate administration process in Delaware can be a tricky task. It's important to understand the timeline of events that must take place before the sale of a house is finalized and an estate is settled.

The length of time it takes to settle an estate after a house sale in Delaware depends on several factors, such as whether or not the deceased left a will, if there are any disputes among heirs regarding ownership of assets, and if there are any outstanding debts that need to be paid off. In most cases, the entire process can take anywhere from two months to even two years depending on how complex the situation is.

When filing for probate in Delaware, it is essential to follow all state laws and regulations so that everything is done legally and efficiently. This may include appointing an executor or administrator if necessary, gathering all documents and records related to the estate, submitting a detailed inventory of all assets and liabilities, filing tax returns on behalf of the deceased, and obtaining court approval for all decisions made throughout the settlement process.

In Delaware, the statutes and regulations governing estates are found in Title 12 of the Delaware Code. This title is divided into four parts: Estates and Fiduciary Relations, Wills and Estates, Probate Proceedings, and Trusts.

Within these sections, several key statutes apply to settling an estate after a house sale including those pertaining to filing inventories of assets, distribution of assets to heirs, payment of taxes and debts from the estate, and administration of wills. Depending on how complex the estate is and other factors such as whether or not there is a will involved, the process for settling an estate can take anywhere from months to years.

It's important for executors or administrators of an estate to understand all applicable Delaware laws in order to ensure that all necessary steps are taken correctly and that any disputes arising from the estate are resolved quickly.

Executing a will in Delaware requires careful consideration and understanding of the estate settlement process. There are several steps to take after a house sale in order to properly settle an estate and all should be taken into account when creating a will.

First, the executor of the will must collect all assets, including real estate, stocks, bonds and other investments. Once collected, these assets must be appraised and valued so that they can be accurately distributed according to the wishes laid out in the will.

When these are complete, debts must be paid off with remaining funds going towards taxes or charitable donations as noted in the will. This is followed by gathering all necessary documents related to the estate such as title deeds, insurance policies and bank statements for distribution among beneficiaries.

Finally, the executor can go through probate court if needed to prove that all legal requirements were met during settlement and distribute any remaining assets according to the will. With this in mind, it's important to consider how much time is needed for settling an estate after a house sale when crafting a will in Delaware.

In Delaware, there are ways to transfer property without involving the probate court. Those include using a trust, transferring property through other forms of ownership like joint tenancy or a life estate, and utilizing beneficiary designations.

A trust is a legal document that allows an individual to transfer assets while they are still alive and designate how those assets will be distributed after death. Joint tenancy allows two or more people to own a single piece of property with equal rights of possession and survivorship rights in the event that one of the owners dies.

A life estate gives someone an interest in real estate for their lifetime and then passes it on to another person upon their death. Additionally, beneficiary designations allow individuals to name beneficiaries who will receive the assets upon their passing without the need for probate court involvement.

Understanding all these options can help ensure that when it comes time to settle an estate after a house sale in Delaware, you have alternate methods available for transferring property quickly and efficiently.

In Delaware, assets subject to probate generally fall into three categories: real property (real estate), personal property, and intangible property. Real property includes land and any buildings or fixtures attached to it, such as a house or other structures.

Personal property consists of tangible items owned by the deceased person, including clothing, furniture and jewelry. Intangible property consists of items that do not have a physical form but still have value, such as stocks, bonds, financial accounts and intellectual property rights.

Probate is necessary for the distribution of these assets after the sale of a house in Delaware. The process can take several months to complete depending on the complexity of the estate and if any disputes arise among beneficiaries.

When a house is sold in Delaware, administering the estate can be a complex and costly process. It begins with paying off any outstanding debts and taxes associated with the estate.

The executor of the estate must also gather all relevant financial documents related to the deceased and their property. These documents must then be filed with the court system in Delaware, as well as other government agencies that may be involved.

After this paperwork is complete, there are often fees associated with legal or accounting professionals who must review them. This cost can increase depending on how complicated the estate is and how many assets it includes.

In addition, there might also be costs related to transferring ownership of property or issuing death certificates. Finally, once all of these steps are complete, a probate judge will need to approve the settlement before it can be finalized.

When handling a decedent's estate in Delaware, it is important to be aware of the possible types of delays that may arise. It generally takes an average of four to six months for the entire process to be completed, but this time can vary greatly depending on certain factors.

The amount of time it takes to settle an estate after a house sale depends on the complexity of the decedent's assets and liabilities, as well as how quickly creditors and beneficiaries are able to provide required documents. Additionally, tax filings must be completed accurately and timely in order for settlements to move forward.

Any disputes or legal disputes that arise can further delay the process significantly. Lastly, if there are any real estate transfers involved, they will need to go through escrow before they can be finalized.

All these potential delays should be taken into account when planning for the settling of a decedent's estate in Delaware.

When it comes to settling an estate after a house sale in Delaware, there are different rules for small estates. In the state of Delaware, probate laws dictate that any estate worth $50,000 or more must go through the formal probate process, which can take up to six months or more.

Smaller estates that are valued at less than $50,000 may be eligible for simplified procedures such as summary administration. These processes can usually be completed within eight weeks and do not require court oversight.

The simplified process is also less expensive since fees are waived and no executor need to be appointed. It is important to note, however, that all estates must go through the same basic steps regardless of size—including paying outstanding debts and distributing assets among beneficiaries—which can add time to the process.

In Delaware, when a house is sold and an estate is settled, the executor or administrator of the estate may be required to post bond as part of the probate process. The purpose of this bond is to protect any creditors or beneficiaries from financial loss due to mismanagement or fraud on behalf of the executor or administrator.

Depending on the size and complexity of the estate, a bond can range from a few hundred dollars to several thousand dollars. In most cases, if an executor or administrator does not have enough funds available for a bond, they can obtain one through an insurance company who will arrange payment plans and other financing options.

The total cost of posting bond in Delaware depends on various factors such as the size of the estate and whether it involves real property. Additionally, it's important to be aware that there are legal restrictions regarding who can serve as an executor or administrator in Delaware; therefore, it's important to consult with an attorney to ensure that all requirements are met before proceeding with this process.

In Delaware, the settlement of an estate after a house sale can be a lengthy process. Beneficiaries of an estate who are looking to access their funds must navigate the state's probate laws and follow specific requirements.

The executor of the estate is responsible for filing all necessary paperwork with the court and providing notice to creditors, heirs and beneficiaries. Once all legal requirements have been met, the executor will distribute assets to beneficiaries in accordance with instructions from the deceased individual's will or as directed by a court order.

Beneficiaries may be able to access their funds by requesting an interim distribution from a court-appointed administrator, who is responsible for overseeing and managing payment of debts and distribution of assets within an estate. In addition, any remaining funds held in trust may need to be released by a trustee before they can be distributed to beneficiaries.

It is important for beneficiaries to understand how these processes work in order to ensure that they receive their rightful inheritance according to Delaware law.

When settling an estate after a house sale in Delaware, the administrator of the estate is responsible for paying creditors in accordance with state laws. During this administration process, it is important to understand the timeline and procedures involved in settling the estate.

It is also necessary to know who is legally responsible for paying creditors during this time. According to Delaware law, it is the responsibility of the administrator to pay all debts owed by the decedent prior to any distribution of assets to beneficiaries.

The administrator must use funds from liquidated assets of the deceased to pay creditors until all debts are satisfied. The executor may also be able to negotiate lower settlements on some debts or payments over time, depending on circumstances.

The timeline for settling an estate in Delaware may vary depending on how quickly all required documents are filed and how many creditors need to be paid. Ultimately, it is up to the administrator of the estate to ensure that all creditors are paid according to applicable laws so that beneficiaries can receive their fair share of assets from the estate.

When selling a house in Delaware, it is important to understand how long it will take to settle an estate. In the state of Delaware, the process of settling an estate after a house sale can vary depending on the complexity of the situation.

However, most estates will be settled within a few months. The time frame for settling an estate in Delaware typically includes submitting and processing paperwork with local government offices, such as obtaining clearance from a probate court or filing inheritance tax returns.

Additionally, resolving any outstanding debts or distributing assets to beneficiaries may add time to the process. Ultimately, there are many factors that can determine how long it takes to settle an estate in Delaware after a house sale; however, if all goes well, it should not take more than a few months.

Most estates in Delaware take anywhere from 6 months to a year to settle after a house sale. This is because of the extensive paperwork and legal work that has to be done before an estate can be settled.

The amount of time it takes to settle an estate largely depends on the size and complexity of the estate, as well as any unresolved issues or disputes between heirs or creditors. For smaller and simpler estates, the process may take less time, while larger and more complicated estates may take longer.

Additionally, if there are any delays due to heirs not agreeing during probate proceedings or complications with creditors, this could further delay the process. Ultimately, it is important for parties involved in an estate settlement to work together with their attorneys in order to ensure that everything is handled according to law and that the process goes as smoothly as possible.

Delaware has particular succession laws for the settlement of estates after a house sale. Generally speaking, succession laws in Delaware dictate that an estate is settled on a case-by-case basis.

The amount of time it takes to settle an estate will depend on factors such as the complexity of the estate, the speed with which documents can be filed and processed, and whether or not probate is required. In many cases, the estate can be settled within three months, but more complex estates may take longer.

Additionally, Delaware state laws require that taxes must be paid before any other distributions are made from the estate. As a result, how long it takes to settle an estate in Delaware may be further extended while taxes are paid.

When settling an estate after a house sale in Delaware, the executor is typically responsible for overseeing the details of the transaction. In most cases, the executor is paid a percentage of the proceeds of the sale.

The exact amount can vary depending on the complexity of the estate and how long it takes to settle it. In Delaware, executors are usually compensated according to their experience and skill level, but typically receive a fee between 5-15% of the total amount.

Furthermore, they may also be eligible for reimbursement for certain expenses related to settling the estate. Additionally, they may be entitled to additional compensation if they work more than 40 hours on any single matter or 50 hours in any given month.

Ultimately, an executor is responsible for ensuring that all necessary paperwork and documents are completed correctly so that everyone involved receives their fair share from the house sale proceeds.

A: It typically takes 8-12 weeks for a devisee to receive their legacy from a testamentary devise after the house is sold in Delaware.

A: The amount of time it takes to settle an estate in Delaware after the sale of a house depends on several factors including the complexity of the estate and compliance with state inheritance laws. Generally, it can take anywhere from 6 months to 2 years to complete the process.

A: It typically takes approximately six months to complete the process of settling an estate when a valid will does not exist.

A: It can take up to 12 months for all the necessary steps to be taken in the settling of a Trust Fund, Federal Estate Tax, Bequests and Register of Wills after a house is sold in Delaware.