Navigating probate and real estate in North Carolina can be a complex process. Understanding the probate process is an essential part of ensuring that all legal requirements are met, and that the rights of the parties involved are respected.

In North Carolina, when an individual passes away, their property and assets must be distributed according to their will or the laws of intestacy if they had not created a will prior to their death. The court will appoint a representative to manage the deceased’s estate through probate, including collecting debts and paying creditors, determining whether inheritance taxes should be paid, distributing assets to heirs, and filing paperwork with the court.

The court will also decide on any disputes between beneficiaries or creditors that arise during this process. Depending on how complicated the estate is, probate can sometimes take several months or even years to complete.

It’s important for those dealing with probate in North Carolina to have a comprehensive understanding of all relevant laws so that they can make informed decisions throughout the process.

Hiring a probate attorney when navigating North Carolina probate and real estate can be extremely beneficial. Expert legal counsel can help to ensure that the process is handled correctly and efficiently, reducing the amount of time it takes to settle an estate.

A probate attorney understands the intricate details of the law and can provide valuable advice on how best to handle various situations related to property rights, inheritance laws, tax implications, and other matters. Additionally, a probate attorney can offer practical guidance on how best to manage estate assets and debts, as well as provide assistance in finding solutions to potential disputes between family members or other parties involved in the proceedings.

With their knowledge of North Carolina law and expertise in handling complex legal issues, a skilled probate attorney can be invaluable when it comes to settling an estate promptly and successfully.

As the executor of an estate in North Carolina, there are a number of responsibilities you must fulfill.

You must ensure that all assets and liabilities of the deceased are identified, valued and managed during the probate process.

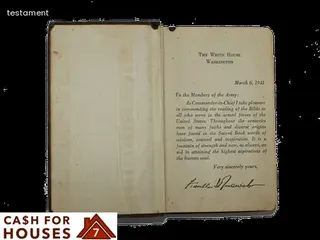

This includes gathering the original will or obtaining letters of testamentary from the court, locating and securing all assets such as real estate, life insurance policies, financial accounts and other personal property, paying any debts or taxes that may be owed by the estate, notifying potential creditors and beneficiaries of their rights to challenge the will or file a claim against the estate, filing required forms with state and federal agencies such as IRS tax returns and ensuring any property is distributed according to the wishes outlined in the decedent's will.

It is important for executors to understand their obligations during this often complex process in order to avoid legal action taken against them.

Navigating North Carolina probate and real estate can be a complicated task. It is important to understand the process of marshaling assets, which involves locating, appraising and collecting all the assets owned by the decedent at the time of death.

This may include tangible items such as jewelry, furniture and vehicles in addition to intangible property like bank accounts or stocks. If there are multiple beneficiaries, it is important to determine who receives what assets in order to ensure that everyone's rights are respected.

When marshaling assets, it is also important to pay any outstanding debts owed by the decedent prior to distributing remaining funds amongst beneficiaries. In some cases, this may involve working with creditors or lawyers in order to collect on debts owed before distribution can occur.

This overview provides an introduction into marshaling assets for those navigating North Carolina probate and real estate law.

When navigating North Carolina probate and real estate, it is important to be aware of the affidavit requirements for claiming personal property. Depending on the situation, the claimant may need to provide an affidavit of heirship or an affidavit of title.

An affidavit of heirship should include information about the deceased person's family members such as their date and place of birth, marriage, death, and surviving family members. An affidavit of title should include a full list of all assets held by the deceased as well as any details pertaining to transfers or changes in ownership that occurred prior to their passing.

Furthermore, any potential claimants must swear that they are not only eligible but also have a legal right to claim the personal property. It is recommended for claimants to seek professional advice from a qualified attorney before submitting any affidavits related to personal property claims.

Navigating the probate and real estate laws of North Carolina can be a daunting task for anyone unfamiliar with the state's legal system. Understanding some of the key differences between North Carolina and other states is essential to ensure that you are compliant with all applicable laws.

Generally, North Carolina requires a will to be signed by two witnesses in order to be valid, while some states may require more. In addition, North Carolina requires court intervention to transfer property ownership when someone passes away; however, many other states allow for an affidavit or will alone to achieve this goal.

Additionally, the timeline for the probate process can vary from state to state; in North Carolina it generally takes anywhere from 8 months to over a year for an estate to go through probate before assets can be distributed among heirs. Finally, there are also differences in how much creditors are able to collect on debts owed by an individual at the time of their death; in North Carolina creditors have up to 6 months after the date of death whereas other states may have different time frames.

Knowing these distinctions is essential when navigating North Carolina's probate and real estate laws.

Navigating probate real estate in North Carolina can be a complex task, and many people have common questions about the process. One of the primary considerations is understanding the timeline associated with completing the probate process.

Generally speaking, it can take anywhere from six months to a year or more for an estate to go through probate court proceedings. Additionally, any creditors of the deceased must be contacted in order for them to make claims on any assets held by the departed individual.

It is important to be aware that any liabilities and debts must be paid off before the remaining assets can be transferred or distributed to heirs or beneficiaries. Furthermore, if real estate is part of the estate, this property must go through a specific set of steps in order to ensure that all legal requirements are met before it can be sold or transferred.

This may include appraisals and inspections as well as obtaining clear title and paying taxes associated with the sale or transfer of real estate. Understanding these steps is key when navigating North Carolina's probate and real estate laws.

Navigating probate and real estate in North Carolina can be a complex process, and understanding the potential benefits and drawbacks of going through probate is essential. Probate is the legal procedure for transferring assets from a deceased person's estate to their rightful heirs.

When an individual passes away without leaving behind a will, their assets are distributed according to North Carolina law, which can be costly and time-consuming. On the other hand, if the deceased had a will, most of their possessions can be passed on without probate court proceedings.

Additionally, if there is no dispute over title or ownership of property, probate might not be necessary as long as all parties agree to transfer ownership without going through the court system. While going through probate typically requires legal fees and court costs, it provides certain protections against fraud or claims by creditors that would otherwise not exist.

Furthermore, because all assets must go through probate before they can be transferred to any heirs or beneficiaries, it protects those who are entitled to inherit from any misappropriated funds or assets that may have been mishandled during this time. Therefore, when making decisions about navigating North Carolina probate and real estate procedures, individuals should carefully consider both the potential benefits and drawbacks of going through probate court proceedings before moving forward.

Navigating North Carolina probate and real estate can be a complicated process for executors and administrators. It is important to understand the filing deadlines associated with this process, as failure to meet these deadlines could result in legal penalties.

In North Carolina, an executor must file an inventory of the deceased person's property within three months of being appointed. This inventory must include all real estate owned by the deceased person.

Within six months of being appointed, executors must also submit a final account to the court for review. The court will then determine if any adjustments need to be made before closing out the estate.

Additionally, any unpaid debts must be paid off within nine months of being appointed or else interest may accrue on those debts. Finally, once all matters have been settled, executors must make a final distribution of assets within 12 months of appointment.

It is important to take note of these deadlines and adhere to them as closely as possible in order to avoid potential legal issues down the line.

When selling a property from probate, it is important to be aware of the North Carolina laws and regulations that must be adhered to. This guide will explain the process for navigating probate and real estate in North Carolina, including how to obtain letters of testamentary, how to file an inventory of assets, who can serve as executor or administrator of the estate, what taxes may apply when a property is sold from probate, and other pertinent information.

Before getting underway with any paperwork or taking steps to list a property for sale, it is important to understand the specific requirements of an estate in order to ensure that all legal matters are handled correctly. Knowing who is responsible for handling state and federal tax forms associated with the sale, as well as understanding the title transfer process and filing deadlines all play into successfully selling a property from probate in North Carolina.

Understanding these details before beginning any part of the process can save time and money in the long run.

Navigating North Carolina probate and real estate can be a daunting task, especially for those unfamiliar with the legal process. At [Name], we understand that no two probate or real estate cases are the same, so we strive to provide comprehensive assistance tailored to each individual’s needs.

Our team of experienced professionals is available to answer any questions and guide you through every step of the process. We can help you understand how to handle property transfers, how to identify personal property and real estate holdings, and more.

Our experienced attorneys will work closely with you to ensure that your rights are protected throughout the probate and real estate process. We also have resources available to assist in filing paperwork correctly, resolving disputes, and executing wills according to the wishes of the deceased.

With our knowledge and expertise, you can trust us to handle any probate or real estate needs competently and efficiently.

Our clients have nothing but good things to say about the comprehensive guide on Navigating North Carolina Probate and Real Estate. One client said, "This guide really helped me understand the process of probating an estate in North Carolina, from start to finish.

It was thorough and easy to understand." Another satisfied customer shared, "I was able to navigate the complexities of real estate transactions in my state with ease thanks to this guide's step-by-step instructions.

I'm so glad I had access to it!" More clients have praised the simple yet detailed style of the guide, noting that it made a complicated task seem relatively straightforward. Many customers have also mentioned how helpful the customer support team was when they needed help understanding something or had a question.

All in all, our clients are pleased with their experience using this guide as a resource for navigating North Carolina probate and real estate.

In North Carolina, the answer to whether real property goes through probate is a bit complicated. Generally speaking, real property in North Carolina may or may not go through probate depending on the circumstances.

Real estate that is titled solely in the decedent's name will pass through probate according to North Carolina law. On the other hand, if real property is held in joint tenancy with right of survivorship or community property with right of survivorship, it typically will not pass through probate.

In addition, certain types of real estate trusts provide for avoidance of probate and distribution of assets without court involvement. Therefore, when navigating North Carolina probate and real estate matters it is important to consider all relevant factors at play in each individual situation.

Yes, estates must go through probate in North Carolina. Probate is the process of administering a deceased person's estate, ensuring that all debts are paid and assets are distributed according to the person's wishes as stated in their will.

In North Carolina, this process is handled by the Clerk of Court in each county. Probate can be a lengthy and complex process, so it is important that anyone navigating North Carolina probate and real estate be aware of their rights and responsibilities during the process.

The state offers resources to assist with understanding the probate process, such as the NC Bar Association's Estate Planning Guide. Additionally, an experienced real estate attorney can provide valuable guidance throughout the entire process.

Understanding how probate works in North Carolina is key for anyone seeking to navigate it successfully.

In North Carolina, a house may be sold while in probate, as long as the deceased's will allows for it. The probate process is often complex and can involve multiple steps.

It is important to understand the regulations and procedures of each step before attempting to sell a house in probate. Before making any decisions, it is essential to seek the advice of an experienced attorney who specializes in North Carolina probate and real estate law.

The lawyer can help evaluate the situation, explain the process, and provide guidance on how best to move forward with selling a house in probate. With their expertise, you can confidently navigate the legal system and ensure that all aspects of the sale are properly handled.

In North Carolina, transferring real estate after death is a complex process that requires knowledge of the state's probate laws. The probate process begins when an estate is opened in the clerk of court's office.

This process includes inventorying and appraising assets, determining if there are debts to be paid, and identifying who will be responsible for managing the estate. Once these steps have been completed, the executor or administrator of the estate can begin to transfer real estate to heirs and beneficiaries.

Depending on whether or not a will exists, real estate may be transferred through either a formal or informal probate proceeding. Formal probate proceedings require a hearing before a judge while informal proceedings do not require court intervention and can often move faster than formal proceedings.

Regardless of which type of probate proceeding is used, it's important to understand that all transfers must be recorded with the register of deeds in order to ensure legal ownership. Once this step has been completed, the property can officially change hands.

Navigating North Carolina Probate And Real Estate: A Comprehensive Guide provides a comprehensive overview on how best to handle these complex processes related to transferring real estate after death in NC.