Understanding Oklahoma probate law is essential for anyone wishing to become the administrator of an estate in the state. The probate process legally transfers ownership of a deceased person's assets to their heirs or beneficiaries.

In Oklahoma, the court must be notified of the death and all creditors must be paid prior to any distribution of assets. Beneficiaries are required to provide proof that all debts have been paid before they can claim any inheritance.

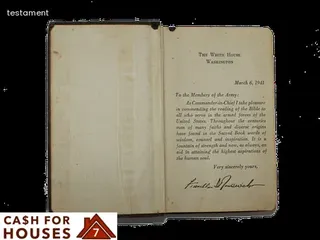

Additionally, an executor will need to submit a variety of documents such as wills, trusts, and other legal agreements to establish ownership rights of property and assets. It is also important to note that individual states have different laws regarding taxes that must be paid on estates and inheritances; in some cases successors may be responsible for paying them.

Finally, if there are disputes among heirs or beneficiaries over the distribution of assets, it is wise for those involved to seek assistance from experienced legal professionals who can help ensure that everything is handled properly and according to state law.

When it comes to estate administration, it is important to understand the difference between a will and a trust. A will is a legal document that sets out the wishes of an individual in terms of how their assets should be distributed after they have passed away.

On the other hand, a trust is an arrangement that is set up during the lifetime of an individual and allows them to have control over their assets even after they have passed away. Both documents are typically used when it comes to estate administration in Oklahoma, but each has its own advantages and disadvantages.

For example, with a will, the process can be more straightforward and open to interpretation while with a trust, individuals may have greater control over their assets and how they are distributed. Additionally, trusts can provide certain tax benefits that wills do not offer.

Ultimately, understanding the differences between wills and trusts is essential for knowing how to properly administer an estate in Oklahoma.

In Oklahoma, establishing a trust is an important part of the probate process when it comes to administering an estate. In order to create a trust, the grantor will need to decide on the type of trust that best suits their needs.

This could be either a revocable or irrevocable trust. A revocable trust allows the grantor to make changes to the trust during their lifetime, while an irrevocable trust cannot be changed once it is established.

The grantor must also name a beneficiary or beneficiaries and determine how they will benefit from the assets in the trust. Once these decisions are made, they can then draft the legal documents that are necessary to create and fund the trust.

Additionally, it is important for those looking to establish a trust in Oklahoma to understand any tax implications associated with creating and funding a trust in their state.

Beneficiaries of a will are the individuals named by the testator (the creator of the will) to receive their estate upon their death. This designation is made through the legal process of probate and must be approved by a court in Oklahoma.

The specifics of who can serve as a beneficiary and how much they can receive are determined by state law, but generally include family members, friends, or charities that are indicated in the will. It's important to note that if an individual dies without a valid will, then any assets held in their name become part of their estate and must be distributed according to Oklahoma intestacy law.

In any case, it is essential for an administrator of an estate to understand the intentions laid out in the will and ensure that those wishes are followed and respected throughout the process.

When determining who has priority as an executor or administrator of an estate in Oklahoma, it is important to understand the relevant probate laws. In general, the court will favor a person named in the decedent's will as their executor or administrator.

Additionally, when no executor is named, state law provides for a priority list of persons who are eligible to serve as an administrator. This list typically starts with the surviving spouse and then goes to other relatives and creditors in descending order of relationship.

The last resort is usually a public administrator appointed by the court. It is also important to note that if there are multiple people on the priority list, they must all agree on who should be appointed or else they must all become administrators together.

Applying to be an administrator or executor of an estate in Oklahoma is a complex process that requires knowledge of the state's probate laws. The primary requirement is to file a petition with the court that provides information about the decedent, their assets and debts, and other pertinent information.

In order to be approved by the court, applicants must typically prove they are qualified to act as an administrator or executor, demonstrate appropriate financial ability to fulfill their duties, and provide proof that all heirs have been notified of their appointment. An attorney should be consulted for specific questions related to the application process and legal requirements of becoming an administrator or executor in Oklahoma.

Additionally, after being approved by the court, administrators or executors must post a bond with the court. The bond is intended to protect all parties involved in the case from any potential losses arising from mismanagement by the administrator or executor.

Furthermore, during this process it’s important for applicants to keep detailed records of all actions taken throughout the administration of the estate.

An executor or administrator of an estate in Oklahoma is responsible for carrying out the decedent's wishes as set out in their will. This includes collecting and safeguarding assets, paying outstanding debts, filing taxes, and administering distributions to appointed beneficiaries.

Additionally, the executor or administrator must ensure that all assets are properly distributed according to Oklahoma probate law. They must also comply with applicable laws when preparing and filing documents, including submitting the will for probate within a certain period of time.

The executor or administrator is also responsible for providing notice to creditors and other parties who may have an interest in the estate. Finally, they must provide a full accounting of any distributions made from the estate to make sure that all parties are aware of how funds have been allocated.

It is important for executors and administrators to understand their responsibilities under Oklahoma probate law before taking on these duties.

In Oklahoma, the rights of an executor or administrator of an estate are set out by probate law. The primary responsibility of an executor is to collect and manage the assets of the deceased.

This includes identifying, appraising, and protecting all property owned by the decedent. An executor also has the authority to sell real estate or other property if necessary.

They must also pay any outstanding debts and settle claims against the estate. Executors are also responsible for filing all necessary tax returns on behalf of the deceased and distributing any remaining assets according to their wishes as stated in a will or, if there is no will, according to Oklahoma intestacy laws.

Administrators have similar duties but may not be given as much autonomy as an executor depending on how the court decides to distribute powers and duties among them.

When it comes to serving as an executor or administrator of an estate in Oklahoma, there are several fees associated with the process. The primary fee is a probate fee, which is calculated based on the value of the estate and is paid out of estate assets.

In addition to the probate fee, executors may be responsible for paying administrative costs associated with settling the estate as well as filing taxes and other documents required by Oklahoma law. It’s important to note that some fees may be waived depending on the size of the estate and whether or not it goes through probate.

Other possible fees may include legal fees incurred during litigation proceedings, costs related to appraising or selling property, or any other expenses incurred in order to settle the estate.

In Oklahoma, the length of probate depends on several factors, including the complexity of the estate and how quickly creditors can be paid. Generally speaking, most probate cases take anywhere from six months to two years to complete.

Smaller estates or those with only a few debts may be completed in a shorter amount of time while larger estates with numerous assets and debts may take longer to settle. Additionally, if there is disagreement among beneficiaries or heirs, this process could be significantly delayed as disputes must be resolved before the case can continue.

The court also has the authority to extend deadlines for specific reasons. Ultimately, it is up to the court to determine how long probate will take in any given case depending on its individual circumstances.

When the time comes to distribute the estate to beneficiaries, the court will examine a number of factors before making a decision. One of the key elements that must be considered is whether or not all creditors have been paid.

This includes any taxes, debts, or other obligations owed by the decedent at the time of death. In addition, if there are any disputes between beneficiaries or other interested parties, they must be resolved before assets can be distributed to those involved.

Another important factor is whether the executor has completed all necessary paperwork and complied with all applicable laws in Oklahoma. Once these conditions have been met and all claims satisfied, a court order will be issued allowing for the distribution of assets in accordance with probate law in Oklahoma.

The probate process can be complex and overwhelming, especially when administering an estate in Oklahoma. However, understanding the basics of protecting assets during the probate process is key to a successful outcome.

The executor must ensure that all outstanding debts are paid out of the estate before any distributions are made to heirs or beneficiaries. It is important to keep detailed records of all transactions related to the decedent's estate and open a separate bank account for all estate funds.

Additionally, ensuring that all assets belonging to the estate are properly inventoried and appraised is essential to protect against potential disputes over ownership or value. As the administrator of an estate, it is also important to keep track of deadlines related to state and federal taxes and ensure they are filed on time.

Properly managing all aspects of an estate during the probate process can help protect assets and ensure a successful outcome.

When dealing with creditors during probate, it is important to understand the legal procedures involved in the process. In Oklahoma, the administrator of an estate has certain duties when it comes to creditor claims.

Every creditor must be given written notice of their rights and a chance to present their claim against the estate. The administrator must then review each claim and decide whether or not it should be allowed or disputed.

When a dispute arises, the administrator must follow state law in responding to any further legal proceedings that may arise from the dispute. It is important for the administrator to understand the laws pertaining to creditor claims and how they apply in Oklahoma so that they can make informed decisions about what action should be taken on each claim made against an estate.

In Oklahoma, estate and trust taxes are handled through the Tax Commission. Depending on the size of the estate, certain trusts may be exempt from taxation; however, larger estates are subject to state income tax.

Other taxes that may apply include inheritance and gift taxes. Trusts established for personal investments or business purposes must pay income tax on all revenue earned by the trust.

The rate of taxation depends on the amount of revenue generated by the trust and can range from 0% to 5%. It is important to consult with a qualified attorney or accountant to ensure that all applicable taxes are properly taken into account when administering an estate in Oklahoma.

Navigating intestate succession laws in Oklahoma can seem daunting when trying to become an administrator of an estate. Knowing the state's probate law is essential for ensuring that the process runs smoothly and the wishes of the deceased are honored.

In Oklahoma, a decedent’s assets pass to their heirs according to the state’s intestacy statutes if they did not have a valid will at the time of death. The court appoints an executor, or personal representative, who is responsible for settling debts and distributing property according to those rules.

If there is no valid will, certain family members may be given preference as administrators over others. Generally, a surviving spouse has priority over other family members and must be given notice before an individual from another family line can serve as executor or administrator.

Intestate succession laws also determine who inherits property when there are no living relatives and under what circumstances. Before becoming an administrator of an estate in Oklahoma, it is important to understand how these laws apply to your case in order to ensure that all assets are distributed appropriately.

Hiring a probate lawyer comes with both costs and benefits. Engaging legal counsel can help to ensure that the requirements of becoming an estate administrator are met, while also helping to protect the executor from any potential liabilities.

While it is feasible to become an estate administrator without legal assistance, it is important to consider the cost-benefit of having a lawyer who is knowledgeable in Oklahoma probate law. It may be worthwhile to consider the time and expense associated with researching and filing paperwork, as well as any other services that could be provided by a knowledgeable attorney.

An experienced probate lawyer can help protect assets, locate creditors and beneficiaries, transfer real estate titles, and handle other tasks associated with settling an estate. Additionally, he or she can provide guidance on how best to manage tax obligations during the process of administering an estate.

Ultimately, assessing the cost-benefit of hiring a probate lawyer can help ensure that all necessary steps are taken in accordance with Oklahoma law when becoming an estate administrator.

Many people make common mistakes when administering an estate in Oklahoma. One of the most frequent errors is failing to properly collect and secure the assets of the deceased, which can lead to a variety of legal problems.

Additionally, it is important to make sure that all beneficiaries are properly notified so that they may receive their share of any assets. Furthermore, it is essential to accurately document all transactions associated with the probate process and submit them for court approval in a timely manner.

It is also important to adhere to applicable state laws when filing documents and completing other tasks related to administering an estate. Additionally, individuals should be aware of any potential tax liabilities that may arise as a result of inheriting items or assets from an estate.

By avoiding these common missteps, individuals will be better equipped to navigate the probate process in Oklahoma efficiently and successfully.

In Oklahoma, any person who believes they have been wrongfully excluded from an estate may contest the will or trust of the deceased. Generally, a person can contest a will or trust if they are able to prove that the document is invalid due to fraud, duress, undue influence, lack of testamentary capacity or failure to meet formal requirements.

Additionally, the court may consider other factors when deciding whether a will or trust is valid such as forgery and mistakes in execution. In some cases, even if a will or trust meets all formal requirements, it may still be contested based on evidence that the decedent was influenced by someone else to make changes to their estate plan.

It is important to note that any challenge must be brought within four years of the decedent's death. If an individual wishes to become an administrator of an estate in Oklahoma, it is important for them to understand the grounds for contesting wills and trusts and ensure that any documentation they present meets all legal requirements.

When someone dies, their estate must be administered according to the wishes of the deceased. In Oklahoma, this process is known as probate and involves a variety of steps that must be taken in order to administer an estate.

One of these steps is reopening wills and trusts after they have been closed. This is necessary when an individual has passed away and an administrator needs to access the assets held in trust for them or claim any remaining assets that were not already distributed.

Reopening wills and trusts can be a complicated process, but it is important to understand the legal implications in order to ensure that all assets are properly distributed. It may also be necessary to hire a lawyer to assist with navigating Oklahoma's probate laws and filing necessary paperwork.

Once reopened, wills and trusts must then be managed correctly so that all parties receive their rightful share of the estate's proceeds.

In Oklahoma, the administrator of an estate is typically the closest living relative of the deceased individual, who may be a spouse, child, or parent. If a person dies without any living relatives, then a court-appointed administrator will manage the estate.

The administrator is responsible for paying all debts and taxes owed by the deceased, as well as distributing assets according to Oklahoma probate law. The administrator must also notify creditors and beneficiaries of their rights under Oklahoma probate law and take steps to protect the interests of all involved parties.

To become an administrator of an estate in Oklahoma, you must be at least 18 years old and have been designated by either a will or intestacy statute. Additionally, you must submit an application to be appointed as an estate administrator with your local probate court.

The primary difference between an executor and an administrator of an estate is the authority granted to each person. An executor is someone appointed by the deceased in their Last Will and Testament to manage their estate after death.

The executor must follow the instructions as stated in the will, and has a fiduciary responsibility to protect and manage assets for the benefit of the beneficiaries. An administrator of an estate is someone appointed by a court to manage an estate when there is no valid Will or when there are no qualified executors available.

The administrator’s powers are more limited than that of the executor, as they must follow court orders rather than instructions from the deceased. In Oklahoma, those wishing to become administrators of an estate must understand probate law, including guardianship laws, tax considerations and other legal matters related to managing an estate after death.

Becoming an executor of an estate in Oklahoma is a process that requires knowledge of the state's probate laws. To be appointed as an administrator of an estate, you must file a Petition for Informal Appointment with the court and submit documents to prove your qualifications.

You may be asked to provide information such as proof of identity, a surety bond, and financial disclosure forms. The court will also review the Will or other documents to determine if you are qualified to serve as executor.

Once appointed by the court, you'll need to take on specific duties such as providing notice to those with interest in the estate, collecting and inventorying assets, paying debts and filing tax returns. You must also distribute assets according to the terms of the Will or applicable laws.

While these tasks can seem daunting at first, it is important that you understand your responsibilities and work diligently so that assets are distributed properly.

In Oklahoma, the executor of an estate must be a resident of the state. The executor is appointed by the probate court and is responsible for filing documents, handling finances, and distributing assets to beneficiaries.

A person can be appointed as an executor through self-appointment or appointment by another party. Self-appointment requires a petition filed with the probate court and an oath that the applicant meets statutory requirements.

A non-resident can be appointed as an executor if they are related to the deceased, but they must have a qualified Oklahoma resident serve as their agent. If there is no will or if there are multiple wills naming different executors, then all of them may be required to serve together in order to fulfill their duties.

For this reason, it’s important to understand Oklahoma's probate laws before taking on such responsibility.